An executive asked my opinion about having his staff all read Good to Great by Jim Collins (2001).

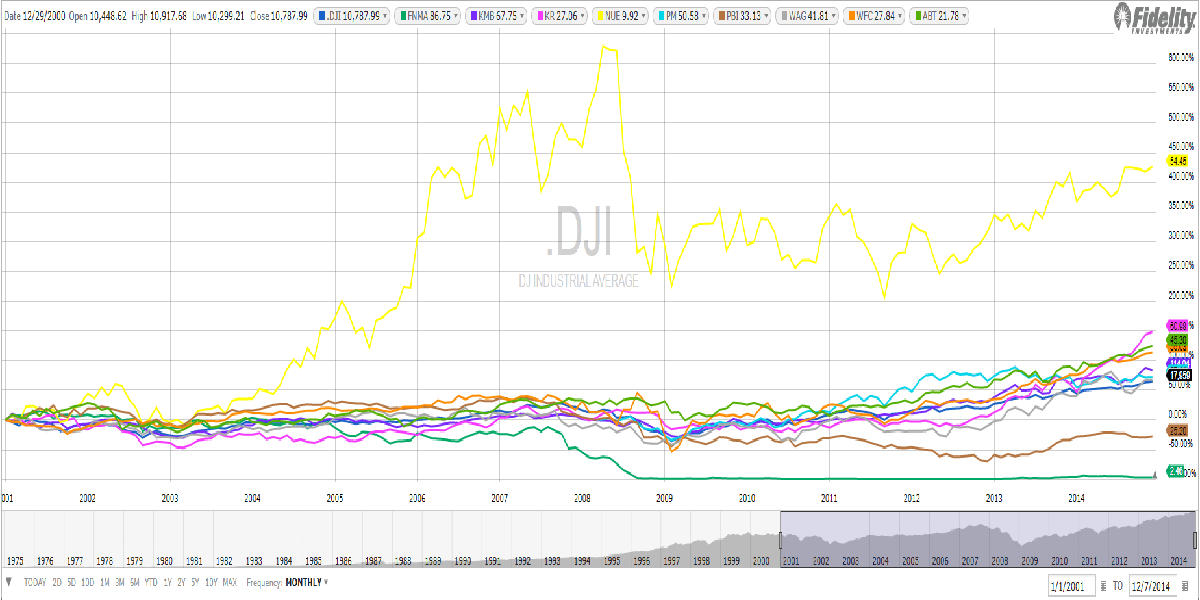

It’s been years since I first read the book, one of many business books collecting dust in my library. When I went back to the list of companies used for research I saw some I knew hadn’t sustained their ‘greatness’. So I looked up their ticker symbols, and here’s the fate of the Not so ‘Good to Great’:

- Circuit City bankrupt, Fannie Mae in conservatorship, Wells Fargo bailed out by US Treasury.

- Only Nucor is really great, up over 400%.

- All others track with the rest of the Dow Jones pack (DJI)

The stocks:

- Abbott Laboratories (ABT)

- Circuit City

- Fannie Mae (FNMA)

- Gillette → Bought by P&G

- Kimberly-Clark (KMB)

- Kroger (KR)

- Nucor (NUE)

- Philip Morris (PM)

- Pitney Bowes (PBI)

- Walgreens (WAG)

- Wells Fargo (WFC)

So given the crummy performance, I have to wonder about the premises made that these companies, that had previously gone from good to great, had some special common characteristics or just random chance.

.